By Raja Chowdhury

Surat: The most favoured word coined by the Indian Government

during the Lockdown period Atmanirbhar

is nothing more than another Jumla, this time targeting the hundreds of thousands of

street vendors and workers who earn their livelihood on daily basis.

The Government with much fanfare announced Atmanirbhar Gujarat Sahay Yojana to support the petty shop owners and street vendors who could avail loan

facilities for the business just on submission of an application regarding

their business affected due to Lockdown. But in reality, it turns to be farce as the

criterias set by the banks can only be fulfilled by the rich business class and

not by the street vendors.

After the first week’s Thali Bajao- Ghanti Bajao managed and

staged by the government to show respect to doctors and others people serving

us during the Lockdown we had several cases where police and the civil society

members beating up doctors, their houses vacated, stone pelting, spitting on

the doctors and hospital staff apart from others.

As the people expected some waivers from the lockdown,

suddenly the Prime Minister Narendra Modi appears on Television and urges

people to become Atmanirbhar (self Reliant) and the government will support

them, especially the small time shop

owners, roadside theli Walas and

other vendors on the roadside through Atmanirbhar Loan Yojana.

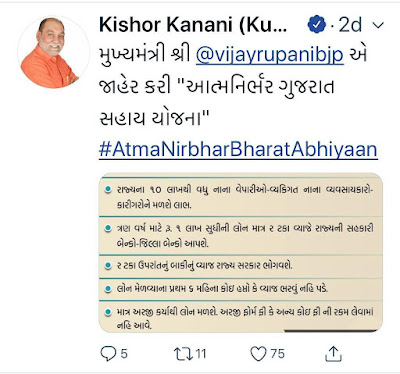

The BJP government in the states to earn brownie points and

become blue eyed boy of the Prime Minister hurriedly released posters and

started tweeting regarding the various sops by them for the poor people.

The Gujarat government too did not lag far behind. In a

series of tweets the Chief Minister Vijay Rupani and the Health Minister Kishor Kanani declared that loans will be

distributed to anybody and everybody who have suffered heavily due to lockdown

and want to start their businesses again. The loans are hazzle free and

available without any trouble. They just need to approach the banks with an

application.

But in reality, these claims by non other than the chief

minister and health minister of a state is nothing more than another Jumla.

Perhaps the latest one to be added to the hundreds of others since 2014.

Last week, Gujarat CM Vijay Rupani had said that a loan of upto Rs. 1 lakh is

available for petty shop owners and is available just on submission of an

application with any bank. The loans has not to be repaid for 6 months and only

after 6 months the installments will begin with an interest rate of 2 percent

of the bank and an interest rate on the principal amount of 6 percent. In total 8 percent will need to be

deposited with the bank.

Gujarat’s Health Minister Kishor Kanani later, on tweeted in

detail that only an application is to be submitted with the bank and nothing

else is required.

Now, when the banks are being approached after some

relaxation in the lockdown, the banks are telling another story. The banks require

all formalities to be fulfilled for a loan like any other loan disbursed

through the bank. They required full scale detailing of the loan seeker

including Income Tax certificates, IT returns of atleast 2 persons you know,

your property details, details of the property you will mortgage for the loan

and details of other properties you have. So a petty juice shop owner on the

street or the next door fruit seller needs to have all these documents to take

a loan upto Rs. 1 Lakh.

And if he is a worker/carpenter/electrician etc, he is only

eligible for a loan upto Rs. 25 thousand and has to fulfil criterias like

having own residential property in the city, atleast 10 year domicile

certificate in the city among others.

Social Activist Sanjay Ezhava has send a legal notice to Gujarat

Chief Minister Vijay Rupani and Health Minister Kishore Kanani asking them how

can they misinform the public being in such a position. The promises made

through the posters and tweets have been broken by the Government and why not a

case be registered against them. A reply has been sought in 7 days.

Comments

Post a Comment